The chart below lists the executive officers and directors who participated in the employee mortgage loan program during the years ended December 31, 20202022 and 20192021 and certain information with respect to their loans. No other directors or executive officers participated in the employee mortgage loan program during the years ended December 31, 20202022 and 2019.2021.

| | | Largest Aggregate | | | | Non- | | Principal | | Principal Paid | | Interest Paid | |

| | Balance 01/01/21 | | Interest | | Employee | | Balance | | 01/01/2021 to | | 01/01/21 to | |

| | | | | | | | | | | | | to 12/31/22 | | Rate | | Interest Rate | | 12/31/2022 | | 12/31/2022 | | 12/31/2022 | |

Name | | Largest Aggregate

Balance 01/01/19

to 12/31/20

$ | | | Interest

Rate

% | | Non-

Employee

Interest Rate

% | | Principal

Balance

12/31/2020

$ | | | Principal Paid

01/01/19 to

12/31/2020

$ | | | Interest Paid

01/01/19 to

12/31/2020

$ | | $ | | % | | % | | $ | | $ | | $ | |

Thomas Schneider | | | 158,326 | | | | 5.250 | % | | | 5.750 | % | | | 144,027 | | | | 14,299 | | | | 15,918 | | |

James Dowd | | | 81,369 | | | | 2.625 | % | | | 3.125 | % | | | — | | | | 81,369 | | | | 2,985 | | | 140,596 | | | 2.250 | | | 2.500 | | ─ | | | 140,596 | | | 2,647 | |

James Dowd | | | 147,000 | | | | 2.250 | % | | | 2.500 | % | | | 140,596 | | | | 6,404 | | | | 1,368 | | | 208,000 | | | 2.125 | | | 2.375 | | | 188,934 | | | 19,066 | | | 4,512 | |

Lloyd Stemple | | | 166,040 | | | | 2.750 | % | | | 3.250 | % | | | 129,585 | | | | 36,455 | | | | 8,181 | | | 129,585 | | | 2.750 | | | 3.250 | | ─ | | | 129,585 | | | 5,455 | |

William O’Brien | | | 142,232 | | | | 2.500 | % | | | 3.000 | % | | | 110,440 | | | | 31,792 | | | | 6,620 | | |

Daniel Phillips | | | 62,134 | | | | 3.625 | % | | | 4.125 | % | | | — | | | | 62,134 | | | | 3,283 | | |

William O'Brien | | | 110,440 | | | 2.500 | | | 3.000 | | | 79,695 | | | 30,746 | | | 4,593 | |

Other than the loans noted in the above table, all other loans made to directors or executive officers:

•

were made in the ordinary course of business;

•

were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the Company; and

•

did not involve more than normal risk of collectability or present other unfavorable features.

All transactions between us and our executive officers, directors, holders of 10% or more of the shares of the Company’s common stock and affiliates thereof, must be approved by a majority of our independent outside directors not having any interest in the transaction, pursuant to our Code of Ethics.

On December 28, 2020, the Bank sold a parcel of property and an existing dwelling that was in the process of being developed into a new branch location, to 506 West Onondaga Associates, LLC.LLC (the "LLC"). Director John P. Funiciello is a member of 506 West Onondaga Associates, LLC. The purchase price of the property was $612,000.

The property will continue to be developed by 506 West Onondaga Associates, LLC up to a total project cost of $2.8 million. All development costs over $2.8 million will be the responsibility of the Bank and treated as leasehold improvements.

In January of 2021, the Bank entered into a lease agreement with 506 West Onondaga Associates,the LLC to lease the entire building located at 506 West Onondaga Street,the site in Syracuse, New York and an adjacent property. In November 2022, this site's development was completed and the vacant property located at 303 Slocum Avenue, Syracuse, New York.Bank opened the building as a full-service branch banking facility. The term of this lease willshall be for a period of thirty-two years and sixty days commencing on February 1, 2021. The Bank will pay the landlord, as total rent for the first twelve months of the lease, the annual sum of $201,168.$201,000. After the first anniversary of the lease, and for every 12 month period following until the end of the lease term, the Bank will pay the landlord, as total rent, the annual sum of $261,996.$262,000.

The property was developed and completed by the LLC up to a total project cost of $2.8 million. All development costs over $2.8 million, were the responsibility of the Bank and treated as leasehold improvements. The property was completed in 2022. Federal and state tax credits in 2022 assisted in offsetting the development costs attributed to the Bank.

The Company’s anti-hedging and anti-pledging provisions are covered in the Company’s Insider Trading Policy. Under the policy, directors and named executive officers are prohibited from engaging in short sales of Company stock and from engaging in transactions in publicly-traded options, such as puts, calls and other derivative securities based on Company stock including any hedging, monetization or similar transactions designed to decrease the risks associated with holding Company stock. In addition, directors and named executive officers are prohibited from pledging Company stock as collateral for any loan or holding Company stock in a margin account.

We have adopted a Code of Ethics that is applicable to our officers, directors and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Ethics is available at the Corporate Information page on our website at https://ir.pathfinderbank.com. Amendments to, and waivers from, the Code of Ethics will also be disclosed on our website.

H.SHAREHOLDER COMMUNICATIONS

| H. | SHAREHOLDER COMMUNICATIONS

|

The Board of Directors has established a process for shareholders to send communications to a director by either United States mail or electronic mail. Any shareholder who desires to communicate directly with our directors should send their communication to Board of Directors, Pathfinder Bancorp, Inc., 214 West First Street, Oswego, New York 13126 or by email to directors@pathfinderbank.com. The communication should indicate that the author is a shareholder and if shares are not held of record, should include appropriate evidence of stock ownership. Depending on the subject matter, management will:

•

Forward the communication to the director or directors to whom it is addressed;

•

Attempt to handle the inquiry directly, for example where it is a request for information about us or it is a stock-related matter; or

•

Not forward the communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate.

At each Board meeting, management shall present a summary of all communications received since the last meeting that were not forwarded and make those communications available to the directors.

III. | MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

|

III.MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The business of the Board of Directors is conducted through meetings and activities of the Board and its committees. During the year ended December 31, 2020,2022, the Board of Directors held eleventwelve regular meetings and twoone special board meetings.meeting. During the year ended December 31, 2020,2022, no director attended fewer than 75 percent of the total meetings of the Board of Directors and committees on which such director served. Much of our work is performed in Committees which is then reported to the full Board. Members in committees are described in the following table:

| | | | | | | | | | |

Director | | Asset/Liability

Committee

(ALCO) Member | Audit Committee Member | Audit

Compensation Committee

Member | Nominating and Governance Committee Member | Compensation

Committee

Member | | Governance and

Nominating

Committee

Member | | Executive

Directors' Loan Review

Committee

Member |

| | | | | |

Eric Allyn | | | | | X |

David A. Ayoub | X | XChair | X | Chair | | X | | | | X |

William A. Barclay | | | X | Chair | | X | | Chair | | X |

Chris R. Burritt | X | X | X | X | Chair |

Meghan Crawford-Hamlin | X | | X | | ChairX |

John P. Funiciello(1) | X | X | | X | | X | | | | X |

Adam C. Gagas | | X | | | | Chair | | | | X |

George P. Joyce

| | XChair | | | | X | | | | X |

Melanie Littlejohn | | | | X | | | | X | | X |

Thomas W. Schneider

| X | | X | | | | | | | X |

John F. Sharkey, III | X | X | X | X | | X | | X | | X |

Lloyd “Buddy”"Buddy" Stemple | Chair | Chair | X | X | | X | | X | | X |

(1) | Mr. Funiciello resigned from the Audit and Compensation Committees once he was no longer an independent director beginning on December 28, 2020.

|

A.NOMINATING/GOVERNANCE COMMITTEE

| A. | NOMINATING/GOVERNANCE COMMITTEE

|

The Nominating/Governance Committee met one timesix times in the year ended December 31, 20202022 to address issues concerning corporate governance, succession planning, and to nominate directors to fulfill the terms of the upcoming year. In the year ended December 31, 2020,2022, the Nominating/Governance Committee was comprised of Directors, Barclay, Burritt, Littlejohn, Sharkey and Stemple, each of whom are “independent” pursuant to the NASDAQ listing requirements. The Nominating/Governance Committee has a charter which is available at our Corporate Information page on our website at https://ir.pathfinderbank.com.

Among other things, the functions of the Nominating/Governance Committee include the following:

•

to lead the search for individuals qualified to become members of the Board and to select director nominees to be presented for shareholder approval;

•

to review and monitor compliance with the requirements for board independence; and

•

to review the committee structure and make recommendations to the Board regarding committee membership.

The Nominating/Governance Committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are first considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service, or if the Nominating/Governance Committee or the Board decides not to re-nominate a member for re-election, or if the size of the Board is increased, the Nominating/Governance Committee would solicit suggestions for director candidates from all Board members. In addition, the Nominating/Governance Committee is authorized by its charter to engage a third party to assist in the identification of director nominees.

The Nominating/Governance Committee would seek to identify a candidate who, at a minimum, satisfies the following criteria:

•

has personal and professional ethics and integrity and whose values are compatible with ours;

•has had experiences and achievements that have given him or herprovided the ability to exercise and develop good business judgment;

•

is willing to devote the necessary time to the work of the Board and its committees, which includes being available for Board and committee meetings;

•

is familiar with the communities in which we operate and/or is actively engaged in community activities;

•

is involved in other activities or interests that do not create a conflict with his or her responsibilities to us and our shareholders;

•

has the capacity and desire to represent the balanced, best interest of our shareholders as a group, and not primarily a special interest group or constituency; and

•

has had a principal residence for two years on a continuous basis within the following counties in New York – Oswego, Jefferson, Lewis, Oneida, Onondaga or Cayuga. Our Bylaws provide that this provision may be overridden by two-thirds vote of the Board of Directors.

The Nominating/Governance Committee will also take into account whether a candidate satisfies the criteria for “independence” under the NASDAQ corporate governance listing standards and, if a nominee is sought for service on the Audit Committee, the financial and accounting expertise of a candidate, including whether an individual qualifies as an Audit Committee Financial Expert. Diversifying our board membership is also an important consideration.

The Nominating/Governance Committee will consider candidates for the Board of Directors recommended by shareholders. In order to make a recommendation to the Board of Directors, a shareholder must own no less than 500 shares of the Company. Shareholders who are so qualified may send their recommendations to our Corporate Secretary for forwarding to the Nominating/Governance Committee. In light of the due diligence required to evaluate recommendations, said recommendations for candidates for the 20222024 annual meeting must be received by the Nominating/Governance Committee by June 30, 2021.

Shareholders may submit the names of candidates to be considered in writing to our Corporate Secretary, at 214 West First Street, Oswego, New York 13126. The submission must include the following information:

•

the name and address of the shareholder as it appears on our books, and number of shares of our common stock that are owned beneficially by such shareholder (if the shareholder is not a holder of record, appropriate evidence of the shareholder’s ownership will be required);

•

the name, address and contact information for the candidate, and the number of shares of our common stock that are owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the shareholder’s ownership should be provided);

•

a statement of the candidate’s business and educational experience;

•

such other information regarding the candidate as would be required to be included in the proxy statement pursuant to SEC Regulation 14A;

•

a statement detailing any relationship between us and the candidate;

•

a statement detailing any relationship between the candidate and any of our customers, suppliers or competitors;

•

detailed information about any relationship or understanding between the proposing shareholder and the candidate; and

•

a statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected.

The Nominating/Governance Committee will consider shareholder recommendations made in accordance with the above similarly to any other nominee proposed by any other source. We have not paid a fee to any third party to identify or evaluate any potential nominees. Moreover, the Nominating/Governance Committee has not received within the last year a recommended nominee from any shareholder.

The Compensation Committee meets periodically to review the performance of officers and to determine compensation programs and adjustments. The entire Board of Directors ratifies the recommendations of the Compensation Committee. In the year ended December 31, 2020,2022, the members of the Compensation Committee were Directors Gagas, Ayoub, Barclay, Burritt, Funiciello, Joyce,Littlejohn, Sharkey and Stemple. All of these directors are “independent” pursuant to NASDAQ listing requirements. Mr. Funiciello resigned from the Compensation Committee once he was no longer an independent director beginning on December 28, 2020. The Compensation Committee met sevenfive times during the year ended December 31, 2020.2022. The Compensation Committee has a charter which is available at the Corporate Information page at our website at https:/ir.pathfinderbank.com.

Any shareholder who wishes to communicate directly with a member of the compensation committee should do so by e-mail to compcommittee@pathfinderbank.com.

In 2020,2022, the Audit Committee consisted of Directors Ayoub, Burritt, Funiciello, Littlejohn, Sharkey, and Sharkey.Stemple. The Audit Committee meets on a periodic basis with the internal auditor to review audit programs and the results of audits of specific areas, on regulatory compliance issues, as well as to review information to further their financial literacy skills. The Audit Committee meets with the independent registered public accounting firm to review quarterly and annual filings, the results of the annual audit and other related matters. The Chairman of the Audit Committee may meet with the Auditors on quarterly filing issues in lieu of the entire committee. The Audit Committee met fourfive times in 2020.2022. Each member of the Audit Committee is “independent” as defined in the listing standards of NASDAQ and SEC Rule 10A(m)-3. Mr. Funiciello resigned from the Audit Committee once he was no longer an independent director beginning on December 28, 2020. Our Board of Directors has adopted a written charter for the Audit Committee which is available at the Corporate Information page on our website at https://ir.pathfinderbank.com. The Audit Committee maintains an understanding of our key areas of risk and assesses the steps management takes to minimize and manage such risks and:

•

selects and evaluates the qualifications and performance of the Auditors;

•

ensures that the internal and external auditors maintain no relationship with management and/or us that would impede their ability to provide independent judgment;

•

oversees the adequacy of the systems of internal control;

•

reviews the nature and extent of any significant changes in accounting principles; and

•oversees that management has established and maintained processes reasonably calculated to ensure our compliance with all applicable law, regulations, corporate policies and other matters contained in our Code of Ethics which is available at the Corporate Information page on our website at https://ir.pathfinderbank.com.ir.pathfinderbank.com.

The Audit Committee has established procedures for the confidential, anonymous submission by employees of concerns regarding accounting or auditing matters.

The Board of Directors has determined that Mr. Ayoub qualifies as an Audit Committee financial expert serving on the committee. Mr. Ayoub meets the criteria established by the Securities and Exchange Commission.

D.ASSET/LIABILITY COMMITTEE (ALCO)

| D. | ASSET/LIABILITY COMMITTEE (ALCO)

|

Pathfinder Bank, the operating subsidiary of the Company has an Asset/Liability Committee. The purpose of the committee is to oversee the asset/liability, interest rate risk, liquidity, capital adequacy, funds management and investment functions of the Bank. Members in 20202022 consisted of Directors Stemple, Ayoub, Burritt, Funiciello, Gagas Joyce and Sharkey. The committee met four times in 2020,2022, each time being assisted bywith the assistance of a professional consultant in ALCO matters.

E.DIRECTORS' LOAN COMMITTEE

| E. | EXECUTIVE/LOAN COMMITTEE

|

Pathfinder Bank’s most significant asset is its loan portfolio. The loan portfolio produces most of the Bank’s revenue but also exposes the Bank to credit and interest rate risk. The Executive/Director's Loan Committee is primarily responsible for monitoring this asset. All of the board of directors are members of the committee. The committee meets generally every other week to respond to customer demands. In addition, the Executive Loan Committee has the authority to make some decisions on behalf of the whole Board when expediency is required.

Pathfinder Bank and the Company have a number of other standing and adhoc committees such as Strategic Planning,Advisory, Facilities and Technology Steering, etc. Board members are encouraged to, and do, attend various committee meetings even if they are not official members in order to get a broader understanding of Bank operations and to give Bank management the benefit of their experience.

IV.COMPENSATION DISCLOSURES

IV. | COMPENSATION DISCLOSURES

|

As a smaller reporting company, we are not required to include a Compensation Discussion and Analysis (“CD&A”) under Item 402(b) of Regulation S-K. Nevertheless, we do want our shareholders to understand our compensation policies and procedures so we incorporate many, but not all, of the required disclosures of a full CD&A.

Our Compensation Philosophy. The Company’s ability to attract and retain talented employees and executives with skills and experience is essential to providing value to its shareholders. The Company seeks to provide fair and competitive compensation to its employees (including the Named Executive Officers described below) by providing the type and amount of compensation consistent with our peers. We also seek to drive performance through short-term incentive compensation and to align our executives’ interest with shareholders with appropriate equity awards.

Compensation Best Practices. Our compensation program is designed to retain eachand reward our Named Executive Officer and alignOfficers by aligning their compensation with short-term and long-term performance. Toward that end, we use the following compensation best practices:

•

Our cash basedcash-based bonus payments are tied to both financial and non-financial performance measures and are subject to a “clawback” policy, providing for the partial or total return of the cash bonus in the event of a restatement of our financial statements which makes the performance measures no longer valid;

•

No tax “gross ups” are included in any employment related agreement;change of control agreements;

•

Our perquisites and personal benefits are limited to those that support a documented business purpose;

•Our change in control provisions in the Company’s employment and other agreements with its Named Executive Officers provide for payment only upon termination of employment or job diminishment in connection with a change in control (also called “double trigger” event);

•

We use appropriate peer groups when establishing compensation; and

•

We balance shortshort- and long-term incentives.

Compensation Program Elements. The Compensation Committee, with the assistance of our consultants, when engaged, has incorporated the following elements into the corporate program to meet the documented corporationcorporate philosophy:

•

Cash based salary and employment benefits that are competitive with our peers;

•

Cash based bonus, directly linking pay to both Company and individual performance;

•

An equity plan designed to align the executives’ interest with the company’sCompany’s shareholders in achieving long-term performance;

•

A qualified 401(k) plan allowing executives to defer “pre-tax”“pre-tax” earnings toward retirement;

An•

A qualified employee stock ownership plan rewarding long-term service to the Company;

•

A defined contribution supplemental executive retirement plan (“SERP”) rewarding long-term service to the Company;Company for certain members of senior management;

Executive •

An executive non-qualified deferred compensation plan allowing executives to defer income for retirement purposes;

•

Insurance programs designed to replace income in the event of sickness, accident or death; and

•Limited perquisites based on demonstrated business purpose.

Role of the Compensation Committee and Consultants. The Compensation Committee annually reviews the performance of the CEO and other executive officers and recommends to the Board of Directors changes to base compensation, as well as the amount of any bonus to be awarded. In determining the compensation of an officer, the Compensation Committee and the Board of Directors take into account individual performance, performance of the Company and information regarding compensation paid to executives of peer group institutions performing similar duties. The CEO recommends to the Compensation Committee, compensation arrangements for the Executive Vice Presidents and Senior Vice Presidents. He does not recommend compensation arrangements for himself or Board members.

While the Compensation Committee and the Board of Directors do not use strict numerical formulas to determine changes in compensation for the CEO, Executive Vice Presidents and Senior Vice Presidents, and while they weigh a variety of different factors in their deliberations, both company-wide and individually-based performance objectives are used in determining the compensation of the CEO, Executive Vice Presidents and Senior Vice Presidents. Company-wide performance objectives emphasize earnings, profitability, earnings contribution to capital, capital strength, asset quality, and return on equity which are customarily used by similarly-situated financial institutions in measuring performance. Individually-based performance objectives include non-quantitative factors considered by the Compensation Committee and the Board of Directors such as general management oversight of the Company, the quality of communication with the Board of Directors, the productivity of employees and execution of the Bank’s Strategic Plan. Finally, the Compensation Committee and the Board of Directors considers the standing of the Company with customers and the community, as evidenced by customer and community complaints and compliments.

Generally, the Company retains a compensation consultant triannuallytriennially coincident with our “Say-on-Pay”“Say-on-Pay” vote. Accordingly, in late 2020, the Compensation Committee engagedretained the services of McLagan Partners, Inc.,“McLagan” to review the (McLagan) as its independent compensation plans for its top seven executives which included the three Named Executives Officers in this proxy statement. Other than set forth herein, McLagan provides no other services to the Company and has no relationships with any directors or executives other than in the role as compensation consultant. The Committee has concluded that McLagan has no conflict of interest in providing services to the Committee.

advisor. McLagan’s report benchmarked senior executive pay, including our Named Executive Officers, against the same pay of the same officers of our peers in the following areas: base salary; annual short-term incentives and long-term incentive compensation.

McLagan has billed the Company $29,960 for their services in 2020. Survey data was also available to supplement the public disclosures of our peers. The following Bank Peer Group was used by McLagan to analyze Pathfinder Bank’s executive compensation.

| | | | | | |

Name

| | Ticker

| | Name

| | Ticker

|

Chemung Financial Corp | | CHMG | | Evans Bancorp, Inc. | | EVBN |

Ameriserv Financial, Inc. | | ASRV | | Union Bankshares, Inc. | | UNB |

Norwood Financial Corp | | NWFL | | First National Corp. | | FXNC |

Middlefield Bancorp | | MBCN | | Severn Bancorp, Inc. | | SBVI |

Greene County Bancorp (MHC) | | GCBC | | Ohio Valley Bancorp | | OVBC |

CB Financial Services, Inc. | | CBFV | | Bank of the James Fnl Group, Inc. | | BOTJ |

SB Financial Group, Inc. | | SBFG | | Emclair Financial Corp | | EMCF |

Farmers & Merchants Bancorp | | FMAO | | Cortland Bancorp | | CLDB |

Fidelity D & D Bancorp, Inc. | | FDBC | | Elmira Savings Bank | | ESBK |

Salisbury Bancorp, Inc. | | SAL | | United Bancorp, Inc. | | UBCP |

McLagan’s report identified the following:Since we will have our next “Say-on-Pay” vote in 2024, a compensation consultant will be retained in 2023.

On average, Pathfinder Bank’s 2020 base salaries for its executive team is 12% below the market median.

B.COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

The three Named Executive Officers, Mr. Schneider, Mr. Dowd and Mr. Rusnak are (10%), (16%) and (17%) below the market median respectively for their base salaries.

Pathfinder Bank’s target cash compensation for its executive team which includes the base salaries plus cash performance bonus is on average 14% below the market median.

Total compensation for the Named Executives Officers in this proxy statement which includes salary, cash performance bonus, long term incentive awards as well as other retirement benefits is on average 13% below the median peer group.

| B. | COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

|

Summary Compensation Table. The following table shows the compensation of James A. Dowd, who was appointed as our Interim President and Chief Executive Officer effective April 15, 2022 and as our President and Chief Executive Officer effective March 29, 2023 and for Thomas W. Schneider, our principal executive officer,former President and Chief Executive Officer for the period of January 1, 2022 through April 14, 2022, along with the two other most highly compensated executive officers (“Named Executive Officers”) that received total compensation of $100,000 or more during the past fiscal year for services to Pathfinder Bancorp, Inc. or any of its subsidiariessubsidiaries. The table includes the compensation awarded, paid to, or earned by, our Named Executive Officers during the years ended December 31, 20202022 and 2019,2021, respectively.

| Summary Compensation Table | Summary Compensation Table | | Summary Compensation Table | |

| Name and Principal Position | | Year | | | Salary | | | Bonus

($) (1) | | | Stock

Options

($) (2) | | | Restricted

Stock

Units

($) (3) | | | Non-Qualified

Deferred

Compensation

Earnings

($) (4) | | | All Other

Compensation

($) (5) | | | Total

($) | | |

Thomas W. Schneider, | | | 2020 | | | | 360,350 | | | | 67,081 | | | | — | | | | — | | | | 6,555 | | | | 130,120 | | | | 564,106 | | |

Name and Principal | | | | | Bonus | | Stock Options | Restricted Stock Units | Non-Qualified Deferred Compensation Earnings | | All Other Compensation | | Total | |

Position | | Year | Salary | | ($) (1) | | ($) | ($) (2) | | ($) (3) | | ($) | |

James A. Dowd (4) | | 2022 | | 259,130 | | | 134,499 | | ─ | | 10,973 | | | 103,205 | | | 507,807 | |

President and Chief | | | 2019 | | | | 360,350 | | | | 60,300 | | | | — | | | | — | | | | 4,302 | | | | 126,804 | | | | 551,756 | | 2021 | | 219,300 | | | 54,540 | | ─ | | 10,867 | | | 87,404 | | | 372,111 | |

Executive Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Thomas W. Schneider (5) | | 2022 | | 253,631 | | ─ | | ─ | ─ | | | 93,232 | | | 346,863 | |

Former President and Chief | | 2021 | | 360,350 | | | 130,147 | | ─ | ─ | | | 659,942 | | | 1,150,439 | |

Executive Officer | | | | | | | | | | | | | |

Ronald Tascarella | | 2022 | | 226,000 | | | 61,346 | | ─ | | 3,801 | | | 67,723 | | | 358,870 | |

Executive Vice President | | 2021 | | 219,300 | | | 53,452 | | ─ | | 3,541 | | | 61,189 | | | 337,482 | |

Chief Banking Officer | | | | | | | | | | | | | |

Walter F. Rusnak | | | 2020 | | | | 190,000 | | | | 32,300 | | | | 73,119 | | | | 101,636 | | | | — | | | | 24,211 | | | | 421,266 | | 2022 | | 205,700 | | | 63,100 | | ─ | ─ | | | 30,786 | | | 299,586 | |

Senior Vice President | | | 2019 | | | | 190,000 | | | | 29,000 | | | | — | | | | — | | | | — | | | | 26,349 | | | | 245,349 | | | | | | | | | | | | |

Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | |

James A. Dowd | | | 2020 | | | | 210,000 | | | | 33,996 | | | | — | | | | — | | | | 8,348 | | | | 84,767 | | | | 337,111 | | |

Executive Vice President | | | 2019 | | | | 210,000 | | | | 30,100 | | | | — | | | | — | | | | 5,538 | | | | 86,529 | | | | 332,167 | | |

Chief Operating Officer | | | | | | | | | | | | | | | | | |

(1) | Current year performance-based bonus awards were paid during March 2021.

|

(2) | Represents the grant date fair value of stock option awards granted to the Named Executive Officer under the 2016 Equity Incentive Plan. The grant date fair value of the stock option awards has been computed in accordance with the stock-based compensation accounting rules (FASB ASC Topic 718). Assumptions used in the calculations of these amounts are included in Note 15 to our Financial Statements in our Annual Report on Form 10-K filed with the SEC on March 30, 2021. While these option expenses are included in this year’s compensation table pursuant to SEC rules, they vest over a three year period, commencing October 28, 2021.

|

(3) | Represents the grant date fair value of $10.37 for the restricted stock awards granted to the Named Executive Officer under the 2016 Equity Incentive Plan. While these restricted stock awards are included in this year’s compensation table pursuant to SEC rules, they vest over a three year period, commencing October 28, 2021.

|

(4) | Represents the non-qualified deferred compensation earnings represents the above market or preferential earnings on compensation that was deferred by each Named Executive Officer.

|

(5) | All Other Compensation consists of the following for each Named Executive Officer for the year ended December 31, 2020:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Named Executive | | Year | | | Employee

Savings Plan

Company

Contribution

($) | | | Automobile

Expense

Reimbursement

($) | | | Club

Dues

($) | | | Life

Insurance

Premium

($) | | | *ESOP

Allocation

($) | | | Supplemental

Executive

Retirement

Plan

($) | | | Total

($) | |

Thomas W. Schneider | | | 2020 | | | | 21,375 | | | | 22,510 | | | | 5,880 | | | | 71 | | | | 15,277 | | | | 65,007 | | | | 130,120 | |

James A. Dowd | | | 2020 | | | | 17,253 | | | | 21,601 | | | | — | | | | 71 | | | | 14,209 | | | | 31,633 | | | | 84,767 | |

Walter F. Rusnak | | | 2020 | | | | 16,425 | | | | — | | | | — | | | | 71 | | | | 7,715 | | | | — | | | | 24,211 | |

* | The ESOP value is calculated based on the Company’s stock price of $11.48 per share as of December 31, 2020.

|

Employment Agreement. The Company and its operating subsidiary, Pathfinder Bank, entered into an employment agreement with Thomas W. Schneider. The agreement has an initial term of three years. Unless notice of non-renewal is provided, the agreement renews annually. The agreement provides for the payment of a base salary, which will be reviewed at least annually, and which may be increased. Under the agreement, the 2021 base salary for Mr. Schneider is $360,350. In addition to the base salary, the agreement provides for, among other things, participation in employee and welfare benefit plans and incentive compensation and bonus plans applicable to senior executive employees, and reimbursement of business expenses.

Mr. Schneider is entitled to severance payments and benefits in the event of termination of employment under specified circumstances. In the event his employment is terminated for reasons other than for cause, disability or retirement, or in the event he resigns during the term of the agreement following:

the failure to elect or re-elect or to appoint or re-appoint him to his executive position;

(1)

2022 performance-based bonus awards were paid during March 2023.

(2)The non-qualified deferred compensation earnings represents the failureabove market or preferential earnings on compensation that was deferred by each Named Executive Officer.

(3)The amounts listed in the “All Other Compensation” column for each Named Executive Officer for the year ended December 31, 2022 are shown in the below table.

(4)James A. Dowd was appointed Interim President and Chief Executive Officer effective as of April 14, 2022, prior to nominate himwhich he served as Executive Vice President and Chief Operating Officer. Mr. Dowd's salary for 2022 reflects a $50,000 salary increase upon his appointment to be elected or Interim President and Chief Executive Officer.

re-elected(5)The compensation for Thomas Schneider reflects the time period of January 1 through April 14, 2022, at which time he resigned as a directorPresident and Chief Executive Officer of the Bank or the Company;

a material change in his functions, duties, or responsibilities, which change would cause his position to become oneCompany. This compensation also reflects Mr. Schneider's services as Director of lesser responsibility, importance or scope;

the liquidation or dissolutionCapital Markets and Corporate Strategy of the Company orfrom April 15, 2022 until September 7, 2022, at which time he resigned from the Bank, other than liquidations or dissolutions that are caused by reorganizations that do not affect his status;

Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Employee Savings Plan Company Contribution | | Automobile Expense Reimbursement | | Club Dues | | Life Insurance Premium | | ESOP Allocation (1) | | Severance (2) | | Supplemental Executive Retirement Plan | | Total | |

Named Executive | Year | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | |

James A. Dowd | | 2022 | | | 20,642 | | | 22,274 | | | 4,050 | | | 76 | | | 21,949 | | | | | 34,214 | | | 103,205 | |

Thomas W. Schneider (3) | | 2022 | | | 22,177 | | | 9,835 | | ─ | | ─ | | ─ | | | 61,220 | | ─ | | | 93,232 | |

Ronald Tascarella | | 2022 | | | 16,592 | | ─ | | ─ | | | 76 | | | 16,841 | | | | | 34,214 | | | 67,723 | |

Walter F. Rusnak | | 2022 | | | 16,877 | | ─ | | ─ | | | 76 | | | 13,833 | | | | ─ | | | 30,786 | |

a relocation(1)

The ESOP value is calculated based on the Company’s stock price of his principal place of employment by more than 30 miles from its location$19.14 per share as of the date of the agreements or;December 31, 2022.

a material breach of the agreements(2)

The severance compensation includes COBRA payments made for Thomas Schneider by the Company orthrough December 31, 2022.

(3)The compensation for Thomas Schneider reflects the Bank

Mr. Schneider will be entitled to a severance payment equal to three times the sumtime period of his base salaryJanuary 1 through April 14, 2022, at which time he resigned as President and the highest rate of bonus awarded to him during the prior three years, payable as a single cash lump sum distribution within 30 days following his date of termination. In addition, the Company or the Bank will continue to provide him with continued life insurance and non-taxable medical and dental coverage for 36 months.

If he voluntarily resigns from his employment with the Company and the Bank, (without the occurrenceChief Executive Officer of the specified circumstances listed above) the Board will have the discretion to provide severance pay to him, provided, however, that such amount does not exceed three times the averageCompany. This compensation also reflects Mr. Schneider's services as Director of the executive’s three preceding years’ base salary, including bonuses, any other cash compensation paid during such years,Capital Markets and the amount of contributions made on behalf of him to any employee benefit plans maintained by the Company or the Bank during such years.

Upon the occurrence of a change in controlCorporate Strategy of the Company or the Bank followed by the Mr. Schneider’s termination of employment for any reason, other than for cause,from April 15, 2022 until September 7, 2022, at which time he will be entitled to receive a single cash lump distribution equal to 2.99 times his average base salary over the previous five years, including bonuses, any other cash compensation paid to him during such years, and the amount of contributions made on behalf of him to any employee benefit plans

maintained by the Company or the Bank during such years. In addition, the Company or the Bank will continue to provide him with continued life insurance and non-taxable medical and dental coverage for 36 months. In the event payments made to him include an “excess parachute payment,” as defined in Section 280G of the Internal Revenue Code, the payment will be reduced by the minimum dollar amount necessary to avoid this result. Should he become disabled, he would be entitled to receive his base salary for one year, where the payment of base salary will commence within 30 daysresigned from the date he is determined to be disabled, and will be payable in equal monthly installments.Company.

Upon his voluntary resignation from employment (without the occurrence of the specified circumstances listed above) he agrees not to compete with the Company or the Bank for one year following his resignation.

Change of Control Agreements. The Company and Pathfinder Bank have entered into Change of Control Agreements with James A. Dowd, Ronald Tascarella and Walter F. Rusnak which provide certain benefits to them should they be “dismissed”in the event of the executive's "dismissal" from employment within a twelve monthtwelve-month period following a change of control of the Company or the Bank. Although “dismissal” does not include a termination for cause or voluntary termination, it does include the executive’s resignation as a result of:

•

a material change in the executive’s functional duties or responsibilities which would cause the executive’s position to become one of lesser responsibility, importance of scope;

•

a relocation of the executive’s principal place of employment by more than 30 miles from its location as of the date of the agreement, or

•

a material reduction in the benefits to the executive as of the date of the agreement.

In the event of such dismissal, the executive, or(or his beneficiary should he die subsequent to the dismissal,dismissal), is entitled to a lump sum payment equal to two times the executive’s most recent annual base salary plus bonuses and any other cash compensation paid to the executive within the most recent twelve (12) month period. The executive is also entitled to continued life, medical and dental coverage for a period of twenty fourtwenty-four (24) months subsequent to the dismissal, and will become fully vested in any stock option plans, deferred compensation plans, or restricted stock plans in which he participates.

Separation Agreement. On September 28, 2022, the Company, on behalf of itself, Pathfinder Bank and any other affiliates or subsidiaries entered into a Separation Agreement and Release with Thomas W. Schneider, the Company’s former Director of Capital Markets and Corporate Strategy, pursuant to which the Company and Mr. Schneider set forth certain rights, covenants and responsibilities between the parties, following Mr. Schneider’s resignation from employment with the Company, which occurred on September 7, 2022. The Separation Agreement includes a general release of claims by Mr. Schneider and in favor of the Company and its current and former directors, officers, employees, associates and other enumerated affiliates.

Pursuant to the Separation Agreement, and in consideration for Mr. Schneider’s commitments and releases set forth therein, the Company paid Mr. Schneider $60,000, less applicable taxes, withholding and deductions. Under the Separation Agreement, Mr. Schneider received health and dental coverage under the Company’s health and dental plans and the Company paid the full amount of such coverage through December 31, 2022. Mr. Schneider received additional Cobra coverage until March 31, 2023.

The Separation Agreement also includes non-disparagement, non-disclosure and non-solicitation provisions and sets forth remedies for breach. Under the Separation Agreement, Mr. Schneider also agrees to make himself available to cooperate with reasonable requests for information relating to his prior position as Director of Capital Markets and Corporate Strategy and to reasonably cooperate with the Company and its counsel in connection with litigation and investigations brought by third parties, if any, and the Company will reimburse Mr. Schneider for his reasonable expenses associated with the foregoing.

Defined Contribution Supplemental Retirement Income Agreements. The Bank adopted a Supplemental Executive Retirement Plan (the “SERP”), effective January 1, 2014. The SERP benefits certain key senior executives of the Bank who are selected by the Board to participate including Thomas W. Schneider and James A. Dowd.participate. The SERP is intended to provide a benefit from the Bank upon retirement, death, disability or voluntary or involuntary termination of service (other than “for cause”), subject to the requirements of Section 409A of the Internal Revenue Code. Accordingly, the SERP obligates the Bank to make a contribution to each executive’s account on the last business day of each calendar year. In addition, the Bank may, but is not required to, make additional discretionary contributions to the executive’s accounts from time to time. All executives currently participating in the SERP are fully vested in the Bank’s contribution to the plan. In the event the executive is terminated involuntarily or resigns for good reason within 24 months following a change in control, the Bank is required to make additional annual contributions equal to the lesser of the contributions required for: (1) three years or (2) the number of years remaining until the executive’s benefit age, subject to potential reduction to avoid an excess parachute payment under Code Section 280G. In the event of the executive’s death, disability or termination within 24 months after a change in control, the executive’s account will be paid in a lump sum to the executive or his beneficiary, as applicable. In the event the executive is entitled to a benefit from the SERP due to retirement or other termination of employment, the benefit will be paid either in a lump sum or in monthly installments for 10 years as detailed in the executive’s participant agreement. The only Named Executive Officers who have Defined Contribution Supplemental Retirement Income Agreements are James A. Dowd and Ronald Tascarella.

Executive Deferred Compensation Plan. Pathfinder Bank maintains an Executive Deferred Compensation Plan for a select group of management employees, including our Named Executive Officers.employees. A participant in the plan is eligible to defer, on a monthly basis, a percentage of compensation received from the Bank, up to $750. The participant’s deferred compensation will be held by the Bank subject to the claims of the Bank’s creditors in the event of the Bank’s insolvency.

Upon the earlier of the date on which the participant terminates employment with the Bank or attains his or her benefit age (as designated by the participant upon joining the plan), the participant will be entitled to his or her deferred compensation benefit, which will commence on the date the participant attains his or her elected benefit age and will be payable in monthly installments for 10 years. In the event of a change in control of the Company or the Bank followed by the participant’s termination of employment within 36 months thereafter, the participant will receive a deferred compensation benefit calculated as if the participant had made elective deferrals through his or her benefit

age. Such benefit will commence on the date the participant attains his or her benefit age and will be payable in monthly installments for 10 years. If the participant dies after commencement of payment of the deferred compensation benefit, the Bank will pay the participant’s beneficiary the remaining payments that were due.

In the event the participant becomes disabled, the participant will be entitled to receive the deferred compensation benefit as of the participant’s date of disability. Such benefit will commence within 30 days following the date on which the participant is disabled and will be payable in monthly installments for 10 years. If the participant dies prior to the commencement of payment of the deferred compensation benefit, the participant’s beneficiary will be entitled to receive a survivor benefit.

2010 Stock Option

The only Named Executive Officers in the Executive Deferred Compensation Plan. The Pathfinder Bancorp, Inc. 2010 Stock Option Plan (the “2010 Stock Option Plan”) was approved at our 2010 Annual Meeting. The 2010 Stock Option Plan authorized the issuance of up to 150,000 shares of common stock pursuant to grants of stock option awards to our senior executive officers are James A. Dowd and outside directors. The options that were granted vest over 5 years (20% per year for each year of the participant’s service), had an exercise price of $9.00, (the market price on the date of the grant) and have an exercise period of 10 years from the date of the grant, June 23, 2011. As a result of the second step conversion of Pathfinder Bancorp, MHC into a fully-converted stock holding company as Pathfinder Bancorp, Inc., both the number of options and the exercise price were adjusted by the exchange ratio of 1.6472. All of the options authorized under this plan have been granted and are fully vested.Ronald Tascarella.

2016 Equity Incentive Plan. The Pathfinder Bancorp, Inc. 2016 Equity Incentive Plan (the “2016 Equity Incentive Plan”) was approved at our 2016 Annual Meeting. The 2016 Equity Incentive Plan authorized the issuance of up to 263,605 shares of common stock pursuant to grants of stock option awards to our senior executive officers and outside directors. The options that were granted to executives vest over seven years (14.3% per year for each year of the participant’s service), have an exercise price of $11.35, (the market price on the date of the grant) and an exercise period of 10 years from the date of the grant, May 6, 2016. All ofAt December 31, 2022, there are 7,148 stock option awards remaining available for future issuance under the remaining options authorized under this plan were granted as follows:2016 Equity Incentive Plan.

On September 11, 2020, 3,000 options were granted to a key management officer which vest over 3 years, have an exercise price of $9.76 (the market price on the date of the grant) and an exercise period of 10 years from the date of the grant, September 11, 2030; and

On October 28, 2020, 48,668 options were granted to senior and key management officers which vest over 3 years, have an exercise price of $10.37 (the market price on the date of the grant) and an exercise period of 10 years from the date of the grant, October 28, 2030.

The 2016 Equity Incentive Plan also authorizesauthorized the issuance of 105,442 shares of common stock pursuant to grants of restricted stock units or shares to our senior executive officers, directors, key management and other officers. The restricted stock units granted to executivessenior executive officers vest over seven years (14.3% per year for each year of the participant’s service). Restricted stock units granted to all other officers vest over fivethree years or threefive years.

Outstanding Equity Awards at Year-End. The following table sets forth information with respect to our outstanding equity awards as of December 31, 20202022 for the Named Executive Officers under our 2010 Stock Option Plan and 2016 Equity Incentive Plan.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Outstanding Equity Awards at Fiscal Year-End | Outstanding Equity Awards at Fiscal Year-End | | Outstanding Equity Awards at Fiscal Year-End | |

Options Awards | Options Awards | | | Restricted Shares | | Options Awards | Restricted Shares | |

| | Grant Date | Number of securities underlying unexercised options exercisable | | Number of securities underlying unexercised options unexercisable | | Option exercise price | | Option expiration date | Number of shares or units of stock that have not vested | | Market value of shares or units of stock that have not vested (3) | |

Name | | Stock Option Plan | | | Grant Date | | Number of

securities

underlying

unexercised

options

exercisable

(#) | | | Number of

securities

underlying

unexercised

options

unexercisable

(#) | | | Option

exercise

price

($) | | | Option

expiration

date | | | Number of

shares or

units of stock

that have not

vested

(#) | | | Market value

of shares or

units of

stock that

have not

vested (5)

($) | | | (#) | | (#) | | ($) | | (#) | | ($) | |

Thomas W. Schneider | |

| May 2016 Stock

Option Grant |

| | | 5/6/2016 | (3) | | | 15,064 | | | | 11,297 | | | | 11.35 | | | | 05/06/26 | | | | 6,780 | | | | 77,834 | | |

| | | | | | | | | | | | |

James A. Dowd | |

| April 2020 Stock

Option Grant |

| | | 6/23/2011 | (1) | | | 6,237 | | | | — | | | | 5.46 | | | | 06/23/21 | | | | | | 5/6/2016 (1) | | 13,554 | | | 2,262 | | | 11.35 | | 05/06/26 | | 1,057 | | | 20,231 | |

| | | | | | | | | | | | |

Ronald Tascarella | | 5/6/2016 (1) | | 13,554 | | | 2,262 | | | 11.35 | | 05/06/26 | | 1,057 | | | 20,231 | |

| |

| May 2016 Stock

Option Grant |

| | | 5/6/2016 | (3) | | | 9,036 | | | | 6,780 | | | | 11.35 | | | | 05/06/26 | | | | 3,165 | | | | 36,334 | | | | | | | | | | | | |

Walter F. Rusnak | |

| May 2016 Stock

Option Grant |

| | | 4/1/2016 | (2) | | | 6,588 | | | | 1,649 | | | | 10.81 | | | | 04/01/26 | | | | 9,801 | | | | 112,515 | | 10/28/2020 (2) | | 9,455 | | | 3,580 | | | 10.37 | | 10/28/30 | | 3,267 | | | 62,530 | |

| |

| May 2016 Stock

Option Grant |

| | | 5/6/2016 | (3) | | | 2,108 | | | | 528 | | | | 11.35 | | | | 05/06/26 | | | | | | 10/28/2020 (2) | | 15,397 | | | 9,643 | | | 10.37 | | 10/28/30 | | | | |

| |

| May 2016 Stock

Option Grant |

| | | 10/28/2020 | (4) | | | — | | | | 39,668 | | | | 10.37 | | | | 10/28/30 | | | | | | |

(1) | The 2010 stock options granted in June 2010, with an option price of $5.46, vested ratably over five years, with an expiration date ten years from the date of the grant, or June 2021. All 2010 stock options were fully vested as of June 23, 2016.

|

(2) | The stock options granted in April 2016, with an option price of $10.81,

(1)The stock options were granted in May 2016, with an option exercise price of $11.35 per share and vest ratably over five years, with an expiration date ten years from the date of the grant, or April 2026. |

(3) | The stock options granted in May 2016, with an option price of $11.35, vest ratably over five or seven years, with an expiration date ten years from the date of the grant, or May 2026.

|

(4) | The stock options granted in October 2020, with an option price of $10.37, vest ratably over three years, with an expiration date ten years from the date of the grant, or October 2030.

|

(5) | At December 31, 2020, there were 39,033 stock options outstanding for the Named Executive Officers.

|

(6) | Reflects the per share value of the restricted stock units as of December 31, 2020 of $11.48.

|

(2)The stock options were granted in October 2020, with an option exercise price of $10.37 per share and vest ratably over three years, with an expiration date ten years from the date of the grant, or October 2030. The awards were split between incentive stock option awards and non-qualified stock option awards in accordance with applicable tax regulations that required that allocation of stock option distributions due to the aggregate value of the stock option awards vesting each year.

(3)Reflects the per share value of the restricted stock units as of December 31, 2022 of $19.14.

Defined Benefit Plan. Pathfinder Bank maintains a tax-qualified noncontributory defined benefit plan (“Retirement Plan”). The Company “froze” the Retirement Plan effective June 30, 2012 (“Plan Freeze Date”). After the Plan Freeze Date, no employee is permitted to commence or recommence participation in the Plan and no further benefits accrue to any plan participants. Employment service after the Plan Freeze Date does continue to be recognized for vesting purposes, however. Prior to the Plan Freeze Date, all salaried employees age 21 or older who worked for the Bank for at least one year and were credited with 1,000 or more hours of employment during the year were eligible to accrue benefits under the Retirement Plan.

At the normal retirement age of 65, the Retirement Plan is designed to provide a life annuity. The retirement benefit provided is equal to 1.5% of a participant’s average monthly compensation for periods after May 1, 2004, through the plan freeze date described above and 2.0% of the participant’s average monthly compensation for credited service prior to May 1, 2004 based on the average of the three consecutive years during the last 10 years of employment which provides the highest monthly average compensation multiplied by the participant’s years of credited service (not to exceed 30 years) to the normal retirement date. Retirement benefits also are payable upon retirement due to early and late retirement. Benefits also are paid from the Retirement Plan upon a Participant’s disability or death. A reduced benefit is payable upon early retirement at or after age 60. Upon termination of employment other than as specified above, a participant who was employed by the Bank for a minimum of five years is eligible to receive his or her accrued benefit reduced for early retirement or a deferred retirement benefit commencing on such participant’s normal retirement date. Benefits are payable in various annuity forms. On December 31, 2020,2022, the market value of the Retirement Plan trust fund was approximately $19.3$16.3 million. The Company made no contribution to the defined benefit pension plan during 2020.2022.

Employee Savings Plan. Pathfinder Bank maintains an Employee Savings Plan which is a profit sharingprofit-sharing plan with a “cash or deferred” feature that is tax-qualified under Section 401(k) of the Internal Revenue Code (the “401(k) Plan”). All employees who have attained age 21 and have completed 90 days of employment during which they worked at least 1,000 hours are eligible to participate.

Participants may elect to defer a percentage of their compensation each year instead of receiving that amount in cash, in an amount up to 75% of their compensation to the 401(k) Plan, provided that the amount deferred did not exceed $19,500$20,500 for 2020.2022. In addition, for participants who are age 50 or older by the end of any taxable year, the participant may elect to defer additional amounts (called “catch-up“catch-up contributions”) to the 401(k) Plan. The “catch-up“catch-up contributions” may be made regardless of any other limitations on the amount that a participant may defer to the 401(k) Plan. The maximum “catch-up“catch-up contribution” that a participant could make in 20202022 was $6,500. For these purposes, “compensation” includes total compensation (including salary reduction contributions made under the 401(k) Plan or the flexible benefits plan sponsored by the Bank), but not in excess of $285,000$305,000 for 2020.2022. The Bank generally provides a match of 100% of the first 3% of the participating employees salary, plus 50% of the next 3% of the participating employees salary. All employee contributions and earnings thereon are fully and immediately vested. Employer matching contributions vest at the rate of 20% per year beginning at the end of a participant’s first year of service with the Bank until a participant is 100% vested after five years of service. Participants also will vest in employer matching contributions when they reach the normal retirement age of 65 or later, or upon death or disability regardless of years of service. To partially offset the impact on employees due to the Retirement Plan freeze discussed above, the Company, on January 1, 2013, began making a 3% safe harbor contribution to all eligible participants in addition to the match contributions described above. The employer safe harbor contribution is fully vested at all times.

For the plan year ended December 31, 2020,2022, the Bank made a matching contribution in the amount of $395,000$433,000 to the 401(k) Plan. In addition, the Company made a safe harbor contribution in the amount of $293,000$337,000 for the 20202022 plan year.

Employee Stock Ownership Plan. Pathfinder Bank maintains an employee stock ownership plan (“ESOP”). Employees who are at least 21 years old with at least one year of employment with the Bank are eligible to participate. On April 6, 2011, the ESOP acquired 125,000 shares of common stock to replenish its ability to make stock contributions to participants’ accounts. The shares were acquired pursuant to a loan obtained from a third partythird-party lender. In connection with the second step conversion and offering, the ESOP purchased an additional 105,442 shares, which equaled 4% of the shares issued in the offering. In connection with such purchase, the ESOP borrowed sufficient funds from the Company to both refinance the remaining outstanding balance on the third-party loan and purchase the additional shares. The Bank makes annual contributions to the ESOP which contributions are used by the ESOP to repay the ESOP loan.

Benefits under the ESOP become vested in an ESOP participant at the rate of 20% per year, starting upon an employee’s completion of one year of credited service, and will be fully vested upon completion of five years of credited service. Participants’ interest in their account under the ESOP will also fully vest in the event of termination of service due to their normal retirement, death, disability, or upon a change in control (as defined in the plan). Vested benefits will be payable generally upon the participants’ termination of employment with the Bank and will be paid in the form of common stock, or to the extent participants’ accounts contain cash, benefits will be paid in cash. However, participants have the right to elect to receive their benefits entirely in the form of cash or common stock, or a combination of both.

| C. | DIRECTORS’ COMPENSATION

|

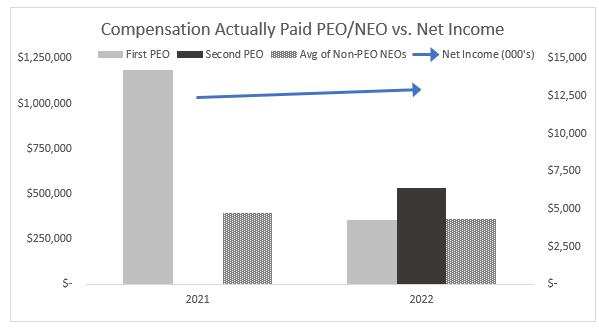

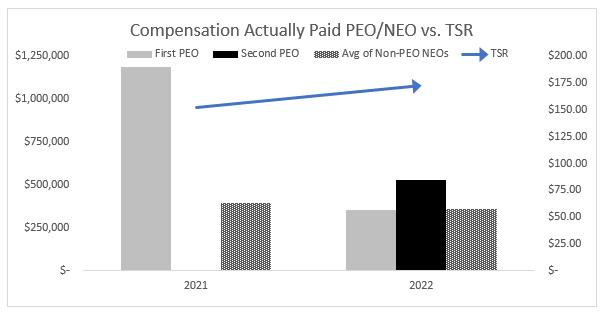

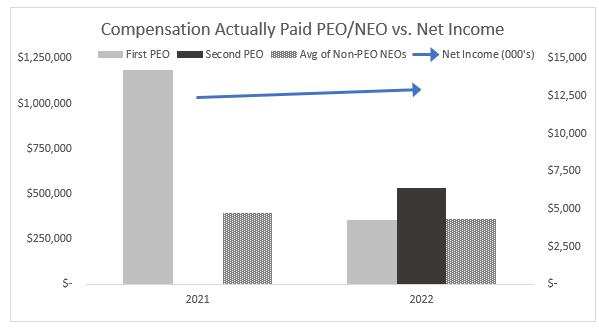

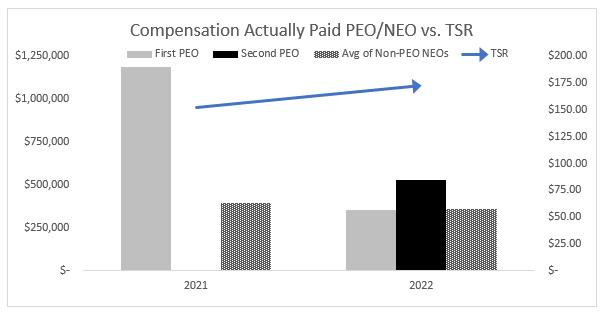

Pay Versus Performance. The following table provides total compensation and compensation actually paid to our principal executive officers ("PEO") and to our named executive officers ("NEOs") for the fiscal years ended December 31, 2022 and December 31, 2021, as well as the Company's total shareholder return ("TSR") and net income.

| | | | | | | | | | | | | | | | | | | | | | | | |

Pay Versus Performance | |

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | |

Year | Summary Compensation Table Total for First PEO (1) | | Summary Compensation Table Total for Second PEO (1) | | Compensation Actually Paid to First PEO (2) | | Compensation Actually Paid to Second PEO (2) | | Average Summary Compensation Table Total for Non-PEO NEOs (3) | | Average Compensation Actually Paid to Non-PEO NEOs (3) | | Value of Initial Fixed $100 Investment Based on Total Shareholder Return (4) | | Net Income ($ In thousands) (5) | |

| $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | |

2022 | | 346,863 | | | 507,807 | | | 356,640 | | | 530,995 | | | 329,228 | | | 360,833 | | | 172.41 | | | 12,932 | |

2021 | | 1,150,439 | | N/A | | | 1,187,702 | | N/A | | | 354,797 | | | 393,857 | | | 151.90 | | | 12,407 | |

(1)For fiscal year 2022, Thomas Schneider served as PEO until April 14, 2022, and James A. Dowd served as PEO effective as April 14, 2022 through the end of the year. Column (a) presents the total compensation from the summary compensation table for Thomas Schneider. Column (b) presents the summary total compensation for James A. Dowd. For fiscal year 2021, Mr. Schneider was the PEO for the entire year fiscal year.

(2)For fiscal year 2022, column (c) presents the compensation actually paid to Thomas Schneider from January 1, 2022 until his resignation on September 7, 2022. Column (d) presents the compensation actually paid to James A. Dowd, following his appointment as Interim President and Chief Executive Officer effective April 15, 2022. These figures are in accordance with the SEC's disclosure requirements regarding pay versus performance.

(3)For fiscal year 2022, columns (e) and (f) present the average summary compensation and average compensation actually paid for our Non-PEO NEOs Ronald Tascarella and Walter F. Rusnak. For fiscal year 2021, columns (e) and (f) present the average summary compensation and average compensation actually paid for our Non-PEO NEOs James A. Dowd and Ronald Tascarella.

(4)Cumulative total shareholder return is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, (assuming dividend reinvestment), and the difference between the Company's common share price at the end and the beginning of the measurement period, by the common share price at the beginning of the measurement period.

(5)Column (h) shows net income as reported on the Company’s consolidated financial statements.

SEC rules require certain adjustments be made to the Summary Compensation Table totals to determine "Compensation Actually Paid" as shown in the Pay Versus Performance Table. Compensation Actually Paid is calculated by adjusting the Summary Compensation Table totals to include the fair market value of equity awards as of December 31, 2022 and 2021, or if earlier, the vesting date (rather than the grant date). The following table presents the total equity adjustments that were made to compensation totals for each year to determine the SEC defined compensation actually paid to each PEO and Non-PEO NEOs.

| | | | | | | | | | | | | | | | |

Year | Principal Executive Officers | Summary Compensation Table Total | | Year-Over-Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years | | Year-Over- Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year | | Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Year | | Compensation Actually Paid | |

| | ($) | | ($) | | ($) | | ($) | | ($) | |

2022 | 1st PEO | | 346,863 | | | 9,768 | | | 24,038 | | | (24,029 | ) | | 356,640 | |

2022 | 2nd PEO | | 507,807 | | | 9,768 | | | 13,420 | | ─ | | | 530,995 | |

2021 | 1st PEO | | 1,150,439 | | | 17,304 | | | 19,959 | | ─ | | | 1,187,702 | |

2021 | 2nd PEO | N/A | | N/A | | N/A | | N/A | | N/A | |

| | | | | | | | | | | | | |

Year | Average Reported Summary Compensation Table Total for Non-PEO NEOs | | Average Year-Over-Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years | | Average Year-Over- Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year | | Average Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Year | Average Compensation Actually Paid | |

| ($) | | ($) | | ($) | | ($) | ($) | |

2022 | | 329,228 | | | 3,968 | | | 27,638 | | ─ | | 360,833 | |

2021 | | 354,797 | | | 28,712 | | | 10,348 | | ─ | | 393,857 | |

The relationship between Compensation Actually Paid and the Company's financial performance for the two-year period as shown in the above Pay Versus Performance Table is illustrated in the two following charts which compares the Compensation Actually Paid to the PEOs and the average Compensation Actually Paid to the Non-PEO NEOs versus TSR and Net Income.

C.DIRECTORS’ COMPENSATION

Each non-employee director receives an annual retainer of $15,000,$20,000, a meeting fee of $800 for each Board meeting attended and $600 for each committee meeting attended, except for ExecutiveDirectors’ Loan Committee fees which are $300 per meeting. The Board Chair receives an additional retainer of $10,100. The Audit Committee Chairman receives an additional retainer of $4,100 and the chairman of all other committees receives an additional $100 for each committee meeting in which they serve in the capacity of committee chairman. Employee directors do not receive any fees. We paid a total of $338,000$462,734 in director fees during the year ended December 31, 2020.2022, which included $48,700 in fees paid to George P. Joyce, Retired Director, who retired from Pathfinder Bancorp, Inc.’s Board of Directors, but continues to serve on Pathfinder Bank’s Board of Directors.

Set forth below is director compensation for each of our non-employeedirectors for the year ended December 31, 2020.2022.

| | | | | | | Fees earned or

paid in cash | | | Non-qualified

deferred

compensation

earnings (1) | | | All Other

Compensation (2) | | | Total | | | Fees earned or paid in cash | | Non-qualified deferred compensation earnings (1) | | All Other Compensation (2) | Total | |

Name | | Year | | | ($) | | | ($) | | | ($) | | | ($) | | Year | ($) | | ($) | | ($) | ($) | |

Eric Allyn | | 2022 | | 19,067 | | ─ | | ─ | | 19,067 | |

David A. Ayoub (3) | | | 2020 | | | | 42,000 | | | | 8,461 | | | | — | | | | 50,461 | | 2022 | | 50,500 | | | 12,500 | | ─ | | 63,000 | |

William A. Barclay (4) | | | 2020 | | | | 33,400 | | | | 4,574 | | | | — | | | | 37,974 | | 2022 | | 43,600 | | | 7,713 | | ─ | | 51,313 | |

Chris R. Burritt (5) | | | 2020 | | | | 50,900 | | | | 26,559 | | | | — | | | | 77,459 | | 2022 | | 65,400 | | | 41,188 | | ─ | | 106,588 | |

Meghan Crawford-Hamlin | | 2022 | | 20,767 | | ─ | | ─ | | 20,767 | |

John P. Funiciello (6) | | | 2020 | | | | 38,400 | | | | 8,461 | | | | — | | | | 46,861 | | 2022 | | 39,400 | | | 12,500 | | ─ | | 51,900 | |

Adam C. Gagas (7) | | | 2020 | | | | 35,200 | | | | — | | | | — | | | | 35,200 | | 2022 | | 40,200 | | ─ | | ─ | | 40,200 | |

George P. Joyce (8) | | | 2020 | | | | 37,200 | | | | 9,621 | | | | — | | | | 46,821 | | 2022 | | 48,700 | | ─ | | ─ | | 48,700 | |

Melanie Littlejohn (9) | | | 2020 | | | | 33,900 | | | | — | | | | — | | | | 33,900 | | 2022 | | 42,400 | | ─ | | ─ | | 42,400 | |

John F. Sharkey (10) | | | 2020 | | | | 35,700 | | | | 4,899 | | | | — | | | | 40,599 | | |

Lloyd “Buddy” Stemple (11) | | | 2020 | | | | 31,300 | | | | 13,715 | | | | — | | | | 45,015 | | |

John F. Sharkey | | 2022 | | 48,700 | | | 8,112 | | ─ | | 56,812 | |

Lloyd "Buddy" Stemple | | 2022 | | 44,000 | | | 18,969 | | ─ | | 62,969 | |

(1)The non-qualified deferred compensation earnings represent the above market or preferential earnings on compensation that was deferred by each director to the Trustee Deferred Fee Plan.

(2)No director received perquisites and any other personal benefits that exceeded, in the aggregate, $10,000.

(3)Mr. Ayoub has 17,023 outstanding stock options.

(4)Mr. Barclay has 8,787 outstanding stock options.

(5)Mr. Burritt has 8,787 outstanding stock options.

(6)Mr. Funiciello has 8,787 outstanding stock options.

(7)Mr. Gagas has 17,023 outstanding stock options.

(8)Mr. Joyce retired from the Board of Pathfinder Bancorp, Inc. on June 4, 2021. He continues to serve as a Director on the Board of Pathfinder Bank.

(9)Ms. Littlejohn has 8,787 outstanding stock options.

(1) | The non-qualified deferred compensation earnings represents the above market or preferential earnings on compensation that was deferred by each director to the Trustee Deferred Fee Plan.

|

(2) | No director received perquisites and any other personal benefits that exceeded, in the aggregate, $10,000.

|

(3) | Mr. Ayoub has 17,023 outstanding stock options and 703 restricted stock units outstanding at December 31, 2020.

|

(4) | Mr. Barclay has 8,787 outstanding stock options and 703 restricted stock units outstanding at December 31, 2020.

|

(5) | Mr. Burritt has 8,787 outstanding stock options and 703 restricted stock units outstanding at December 31, 2020.

|

(6) | Mr. Funiciello has 8,787 outstanding stock options and 703 restricted stock units outstanding at December 31, 2020.

|

(7) | Mr. Gagas has 17,023 outstanding stock options and 703 restricted stock units outstanding at December 31, 2020.

|

(8) | Mr. Joyce has 6,287 outstanding stock options and 703 restricted stock units outstanding at December 31, 2020.

|

(9) | Ms. Littlejohn has 8,787 outstanding stock options and 703 restricted stock units outstanding at December 31, 2020.

|

(10) | Mr. Sharkey has 17,023 outstanding stock options and 703 restricted stock units outstanding at December 31, 2020.

|

(11) | Mr. Stemple has 1,758 outstanding stock options and 703 restricted stock units outstanding at December 31, 2020.

|

Director fees are reviewed annually by the Compensation Committee for recommendation to the Board of Directors. The Committee reviews relevant peer group data similar to that used in the executive compensation review. The Committee believes that an appropriate compensation is critical to attracting, retaining and motivating directors who have the qualities necessary to direct the Company.

In 2020, the Compensation Committee retained the services of McLagan to complete our triennial study of compensation for Named Executive Officers as well as our independent board members. McLagan used the same publically traded Bank peer group for directors’ compensation as was used for the Named Executive Officers.

McLagan concluded in their 2020 independent review of director compensation that aggregate Director Compensation was competitive to the peer banks.

Trustee (Director) Deferred Fee Plan. Pathfinder Bank maintains the Trustee Deferred Fee Plan for members of the BoardsBoard of Directors of Pathfinder Bank and the Company. A participant in the plan is eligible to defer, on a monthly basis, up to the lesser of (i) $2,000 or (ii) 100% of the monthly fees the participant would be entitled to receive each month. The participant’s deferred fees will be held by the Bank subject to the claims of the Bank’s creditors in the event of the Bank’s insolvency.

Upon the earlier of the date on which the participant’s services are terminated or the participant attains his or her benefit age (as designated by the participant upon joining the plan), the participant will be entitled to his or her deferred compensation benefit, which will commence on the date the participant attains his or her elected benefit age and will be payable in monthly installments for 10 years. In the event of a change in control of the Company or the Bank followed by the participant’s termination of services within 36 months thereafter, the participant will receive a deferred compensation benefit calculated as if the participant had made elective deferrals through his or her benefit age. Such benefit will commence on the date the participant attains his or her benefit age and will be payable in monthly installments for 10 years. If the participant dies after commencement of payment of the deferred compensation benefit, the Bank will pay the participant’s beneficiary the remaining payments that were due.

In the event the participant becomes disabled, the participant will be entitled to receive the deferred compensation benefit as of the date of the participant’s disability. Such benefit will commence within 30 days following the date on which the participant is determined to be disabled and will be payable in monthly installments for 10 years. If the participant dies prior to the commencement of payment of the deferred compensation benefit, the participant’s beneficiary will be entitled to receive a survivor benefit.

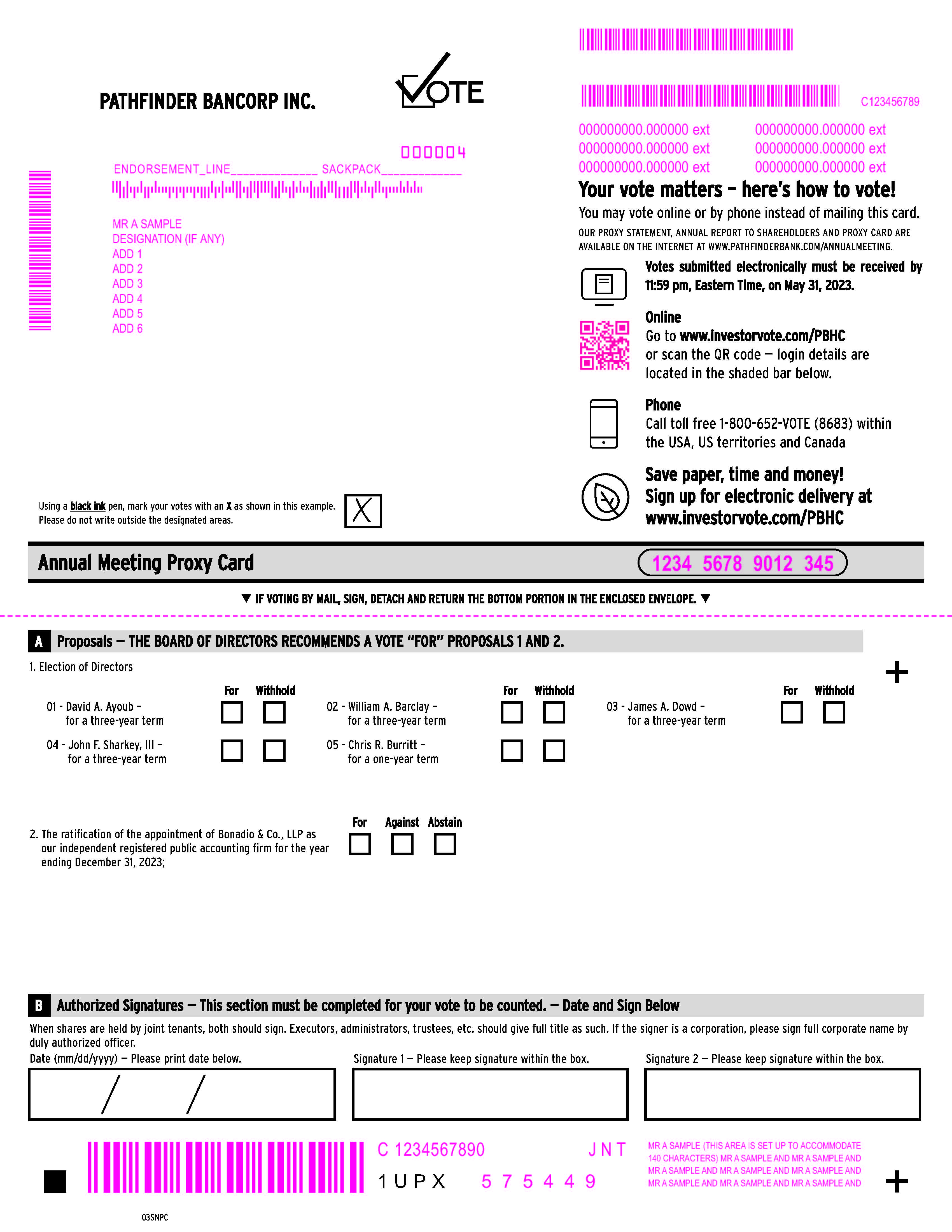

V.PROPOSAL 1 - ELECTION OF DIRECTORS

V. | PROPOSAL 1—ELECTION OF DIRECTORS

|

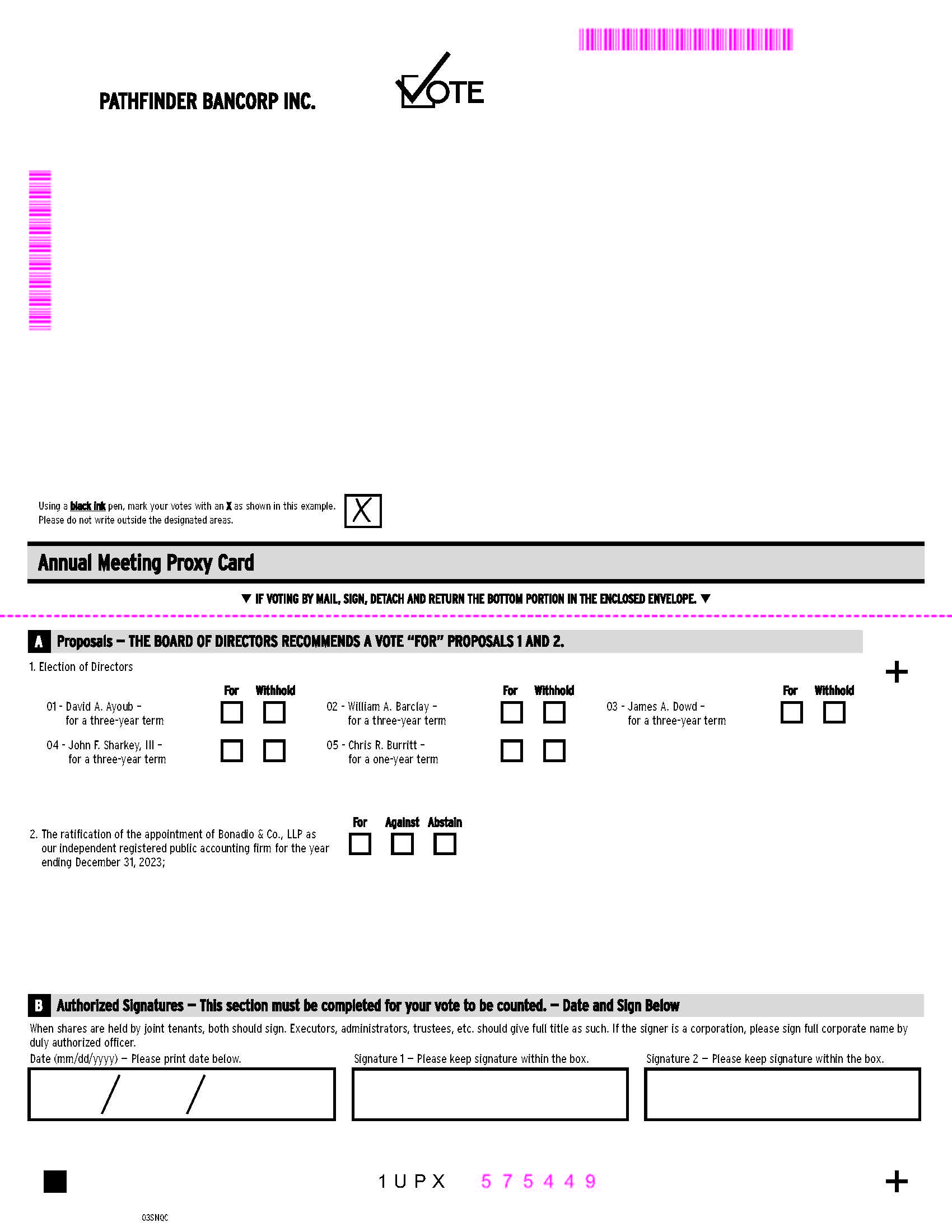

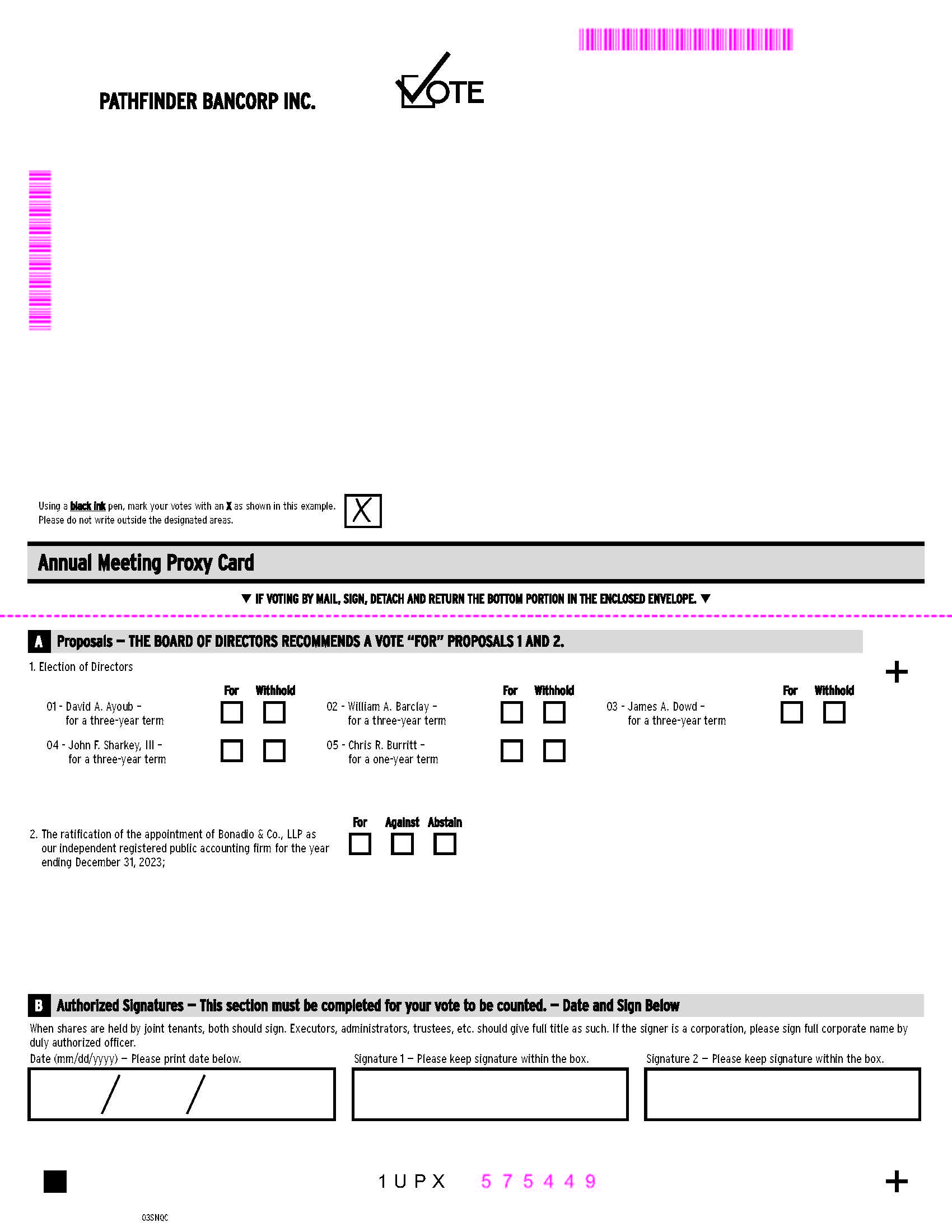

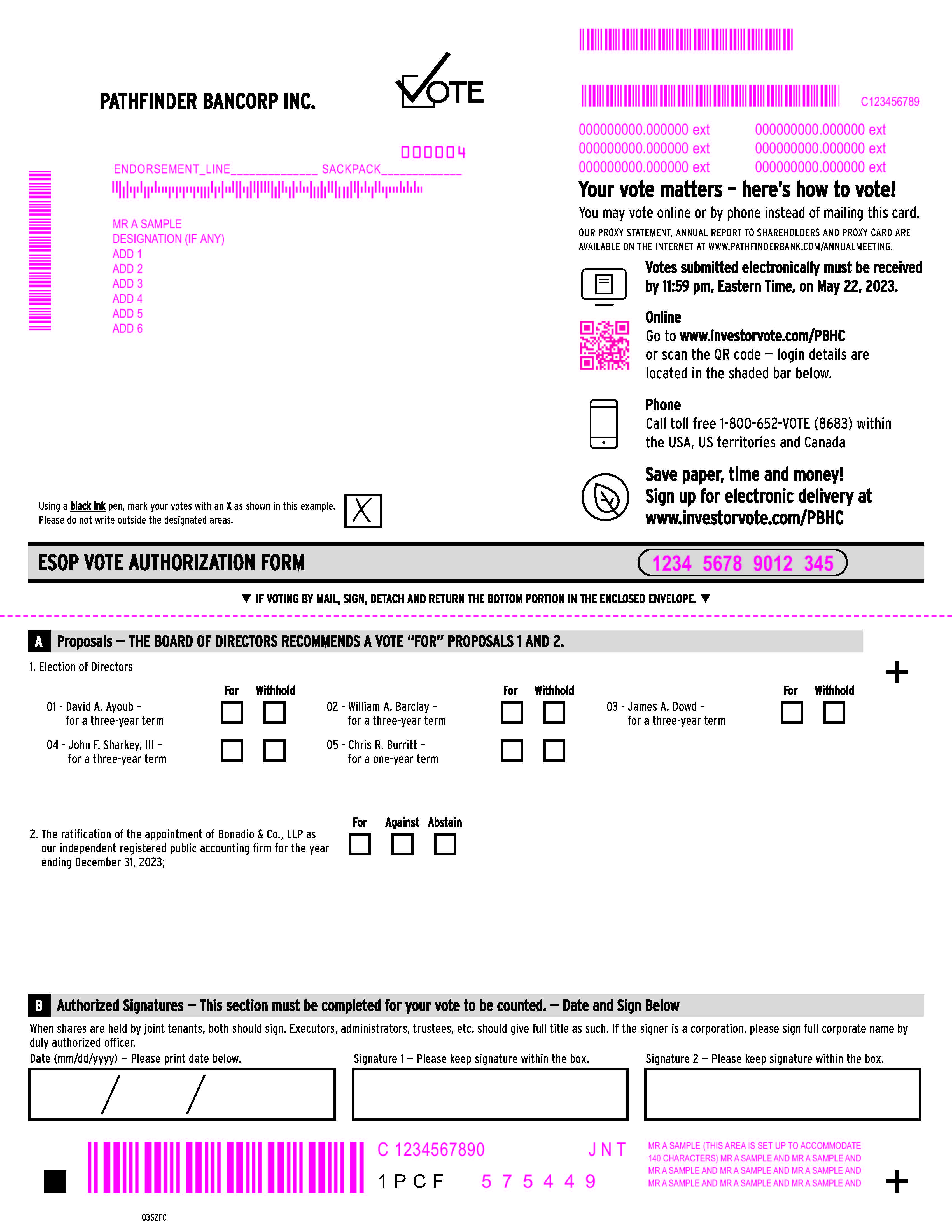

Our bylaws presently allow the Company to fix the number of directors.Directors. The number is fixedof Directors of the Company shall be set at nine directors when our Director, George P. Joyce, retires on June 4, 2021.eleven. Our bylaws provide that the number of directorsDirectors be divided into three classes, as nearly equal in number as reasonably possible, and for approximately one third to be elected each year. Directors are generally elected to serve for a three-year period and until their respective successors shall have been elected and qualify. We are nominating the following personsIn order to provide for three "nearly equal" classes of Directors, Chris R. Burritt will be nominated for a one-year term and David A. Ayoub, William A. Barclay, James A. Dowd and John F. Sharkey, III are each nominated for three-year term: John P. Funiciello; Thomas W. Schneider and Lloyd “Buddy” Stemple.terms.

| A. | COMPOSITION OF OUR BOARD

|

A.COMPOSITION OF OUR BOARD

The table below sets forth certain information regarding the composition of the Board of Directors and Director Nominees, including the terms of office of Board members. It is intended that the proxies solicited on behalf of the Board of Directors (other than proxies in which the vote is withheld as to one or more nominees) will be voted at the Annual Meeting for the election of the nominees identified below. If the nominee is unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may recommend. At this time, the Board of Directors knows of no reason why any of the nominees would be unable to serve if elected and each nominee has agreed to serve if elected. Except as indicated herein, there are no arrangements or understandings between any nominee and any other person pursuant to which such nominee was selected.

| | | | | | | | | | | | | | |

Name (1) | | Age (2) | | | Position Held | | Director

Since (3) | | | Current Term to

Expire | |

Nominees | | | | | | | | | | | | | | |

John P. Funiciello | | | 57 | | | Director | | | 2011 | | | | 2021 | |

Thomas W. Schneider | | | 59 | | | Director, President and Chief Executive Officer | | | 2001 | | | | 2021 | |

Lloyd “Buddy” Stemple | | | 60 | | | Director | | | 2005 | | | | 2021 | |

Directors Continuing in Office | | | | | | | | | | | | | | |

David A. Ayoub | | | 58 | | | Director | | | 2012 | | | | 2022 | |